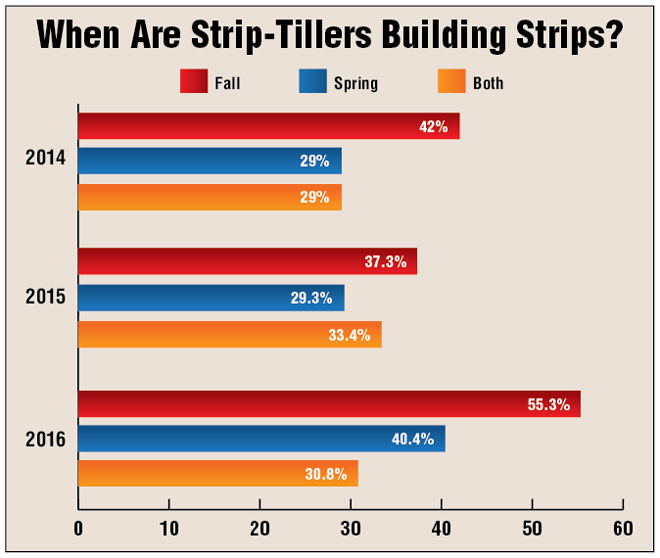

Timing can be everything when building strips, and in talking with farmers, it seems more are becoming loyal to one time of year or the other, depending on convenience, weather or availability of hired help.

These preferences were even more pronounced in the 4th annual Strip-Till Operational Benchmark study, compared to prior years. The percentage of farmers who prefer to build strips in fall or spring both increased by double digits for the 2016 cropping season.

For the third year in a row, the majority of strip-tillers prefer fall strip-till with 55.3% getting back into the field after harvest. This marks a 13-point increase over 2015 (42.3%) and a 17-point jump over 2014 (38.6%).

But those farmers preferring to build strips ahead of planting also increased from a low of 28.7% in 2015 to a new high of 40.4% last year. With more defined preferences, it made sense that the number of respondents who strip-till in both spring and fall declined to 30.8% from a high of 35.6% in 2015.

Situational Setups

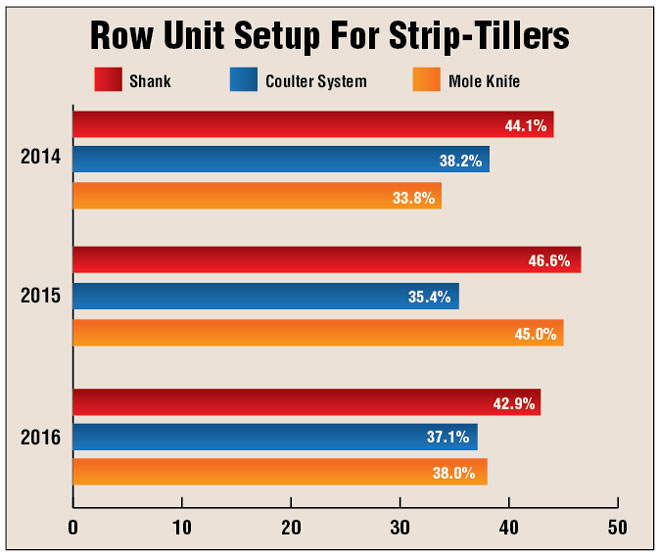

While data revealed dramatic year-over-year differences in when farmers build strips, there was less variance in the type of row unit setups strip-tillers utilize. At least 37% of respondents said they used either shank-style, coulter system or mole knife setups on their strip-till rig.

Talking with farmers during the last year, several had added new, used or modified secondary strip-till rigs for use during different seasons, with shanks more commonly associated with fall strips and coulters utilized in spring. While strip-tillers often have an ideal window for when they like to build strips, it’s not always possible. So having a back-up plan with the right equipment can be an asset.

For the fourth year in a row, the most popular setup was shank-style row units, although the percentage has declined the last 2 years. Some 42.9% of strip-tillers utilize shanks, compared to 44.3% in 2015 and 46.7% in 2014.

Use of coulter setups increased from 32.9% in 2015 to 37.1% last year, validating the increase in spring strip-till in 2016, but the total is well below the 45% who utilized the system in 2014. Use of mole knife setups also increased, albeit slightly, from 36.7% in 2015 to 38% last year.

A new question asked strip-tillers to identify their most effective residue management practices ahead of building strips. By far the most popular method was row cleaners, either on the planter (86.7%) or strip-till rig (74.1%). A distant third was sizing residue with combine attachments (27.6%).

Equipment Consistency

Despite the increase in strip-till acreage, the size of machines farmers pulled through their fields in 2016 remained relatively unchanged compared to the prior year.

Leading the way again as the most popular size strip-till rig in 2016 was a 12-row machine at 43.4%, consistent with 2015 (44.4%) and only about 3 points off 2014 (46%). Another 31.6% utilize 16-row rigs, also on par with prior years.

Some 19% run 6- or 8-row strip-till rigs, and a handful of strip-tillers noted they ran 4-row machines. On the other end of the spectrum, 6% of respondents ran 24-row strip-till rigs, marginally higher than 2015 (5.8%) and 2014 (5.4%).

Tractor horsepower needed to pull strip-till rigs continued to inch upward, for an average of 328 in 2016, compared 325 in 2015. It’s worth noting that since the first benchmark study analyzing the 2013 cropping year, strip-tillers have increased tractor horsepower needs by 50 in just 4 years, a trend worth watching in the coming years.

Manufacturer Movement

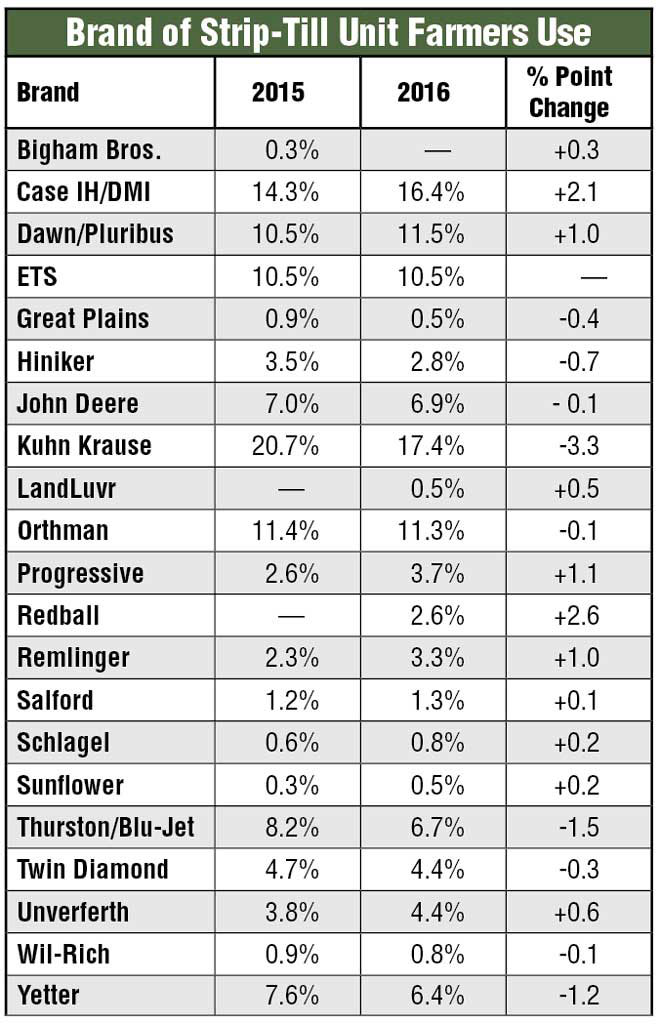

Farmers tend to be brand loyal when it comes to equipment, but there is also an innovative streak that runs through some strip-tillers as they strive to update, improve or even rebuild strip-till rigs.

Sitting down with a diverse group of strip-tillers during a roundtable discussion earlier this year, Frankton, Ind., farmer Mike Shuter candidly noted, “In strip-till, if you haven’t gone through a dozen [equipment] preparations, you haven’t gotten to where you need to be.”

Strip-tillers have a multitude of customizable options to adapt to their operation and results revealed a competitive market, with no company’s strip-till rig reaching at least 20% for the first time in the history of the study.

For the third straight year, Kuhn Krause proved to be the most popular strip-till rig run by respondents at 17.4%, although the total was down about 3 points from 2015 and 5 points from 2014.

Ranking second for the third year in a row was Case IH/DMI with 16.4%, up about 2 points from 2015, followed by Dawn Equipment (11.5%), which moved up one spot from 2015 (10.5%), followed by Orthman (11.3%), down one spot, and Environmental Tillage Systems (10.5%).

Rounding out the top 10 was John Deere (6.9%), Thurston Mfg./Blu-Jet (6.7%), Yetter Mfg. (6.4%), Unverferth (4.4%) and Twin Diamond (3.8%).

The Top 10%

So how do the equipment setups of the highest-yielding strip-tillers compare to the overall group? While the majority still utilize shank systems (52.5%), this marked a nearly 7% drop over 2015 (59.4%), but still well ahead of 2014 results (27.3%).

The biggest gain came in the number strip-tillers using mole knives — 42.5% in 2016 — compared to 31.3% in 2015 and 32.3% in 2014. Coulter systems also saw growth among the top yielding strip-tillers, from 25% in 2015 to 30% last year.

Worth noting is that nearly one-quarter (22.5%) of the top tier strip-tillers utilized multiple row-unit setups on their strip-till rigs, signaling seasonal flexibility and a willingness to match equipment setup to field conditions.

Generally consistent with the overall group, only 46.2% of the top strip-tillers ran 12-row strip-till rigs. But this total was well below the 62.5% of the top 10% who ran 12-row machines in 2015.

Making up the some of the difference was the number of strip-tillers running 8-row machines. This total increased from less than 1% in 2015 to 12.8% last year.

Also increasing were the number of top strip-tillers running 16-row machines from 31.3% in 2015 to 35.9% last year.

As for which brand of rig the highest-yielding strip-tillers preferred, Kuhn Krause was on top at 27.5%, about 10 points higher than the overall group (17.4%).

Coming in second was Orthman (17.5%), down about 8% after holding the top spot in 2015.

Overall, 14 different manufacturers were represented among the strip-till brands run by the highest yielding strip-tillers.